Parking Valuation

Q-Park is an operator of parking garages in Belgium, Denmark, Germany, France, Ireland, the Netherlands, and the United Kingdom. Headquartered in Maastricht, it is the largest parking provider in the Netherlands and second in the European market.

Q-park was acquired by KKR, a leading investment firm that manages multiple asset classes, for 2,905 mn euros.

Strategically, the transaction gives KKR a significant European presence in a niche yet relatively growing asset class.

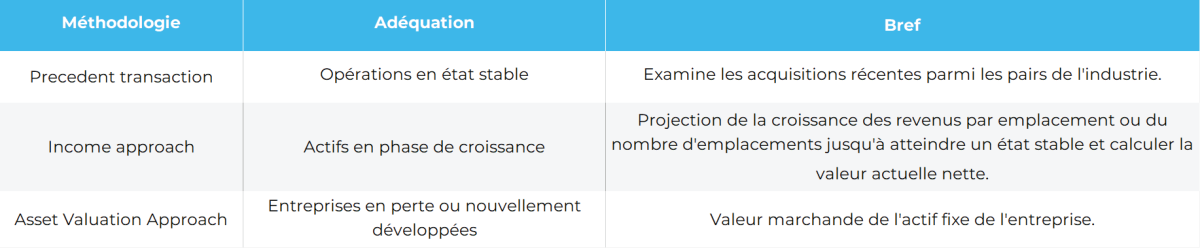

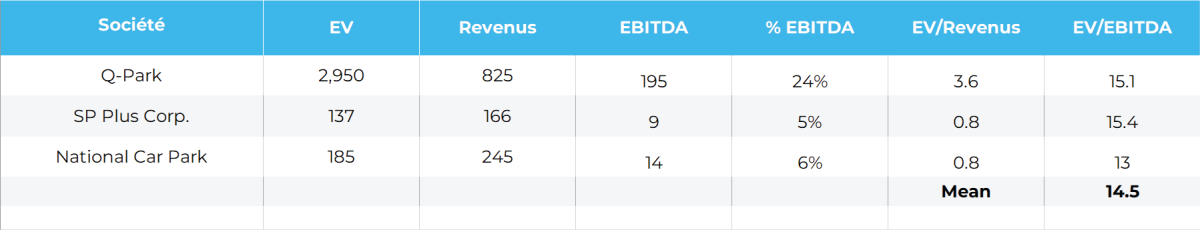

Using the precedent transaction methodology, we compare Q-park’s acquisition to some of the recent peer acquisitions and their valuation multiples. We can see that the revenue multiple increases with a higher EBITDA margin, whereas the EBITDA multiple is in a steady range of 13 to 16 across peers.

Comparing recent transactions concerning Q-park’s peers, SP Plus and NCP, were materialized for 137mn and 195 euros respectively, which is very close to 0.8x EV/Revenue we have here.

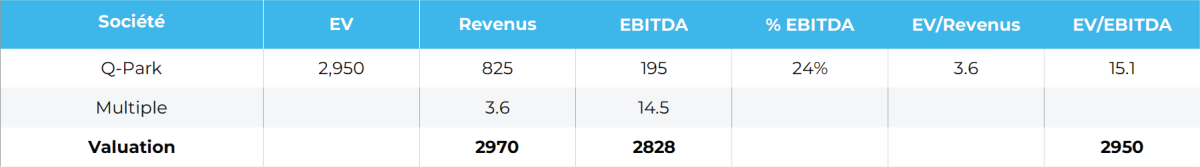

As Q-Park has a higher EBITDA margin than the competitor SP Plus, it should have a higher revenue multiple. Assuming a 3.6x revenue multiple on Q-park’s revenue we achieve a value very close to 2,950 billion euros.

We can verify this by taking the mean enterprise value to EBITDA multiple of the peer group and applying to Q-Park’s EBITDA. Here we again obtain a value close to the value derived from the revenue multiple.

Specialists for every situation

Rodschinson Investment is your trusted investement partner to make the smartest possible move whatever is your current situation.

Bastion Tower (level 11-12)

5, Place du Champ de Mars

1050 Brussels, Belgium